Belgium: Evolution of the Belgian Beer Market 2022

The Belgian Brewers have published their annual report 2022. Always interesting to take a look at the latest evolutions.

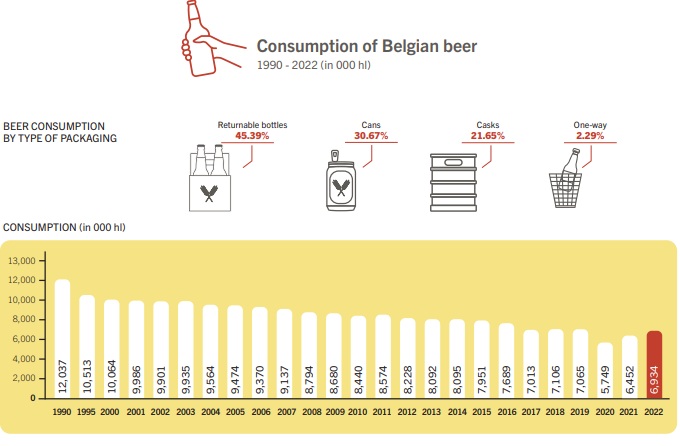

With 6,933,507 hl, consumption levels in 2022 were almost the same as in 2019, the year before the Corona pandemic. There is still a slight decrease of 2%, being 100,000 hl. The loss is more significant in the hospitality market (-5.8% vs. 2019) than in the retail market, where volumes are 1% higher than in 2019.

When we compare 2022 with 2021, we get a completely different picture. In 2022, the hospitality sector experienced growth of 42.4%, giving a total volume of 2,825,210 hl. Retail, on the other hand, declined by 8% last year, arriving at a total volume of 4,107,997hl.

67 % are sold in refillable packaging: 45 % in guaranteed bottles and 22 % in kegs. Cans represent 31 % of sales. One way bottles only 2 %.

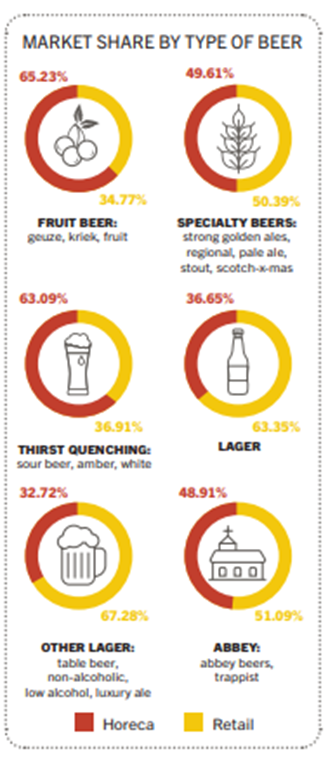

Let’s take a look at the evolution of the different beer types. To filter out the Corona pandemic, let’s compare the 2022 figures with those of 2019. Pils remains by far the most important type, accounting for 66 % of beer consumption. In terms of volume, lager is experiencing a 2% decline. In retail, the volume of lager remains at the same level, but in the on-trade it experiences a 7% decline. This is slightly more than the total decline of the on-trade over the same period.

The “Other lager” type (includes table beer, non-alcoholic beers, low-alcohol beers and luxury lagers) experienced a 3% increase. This segment represents just under 5% of the total beer market, notwithstanding the addition of many new references. In retail, this category is up 8%, whereas in the on-trade it is down 7%.

Sour, amber and white beers make up the “Thirst quenching” type of beer. 63 % of this category is sold in the on-trade, but declines in volume by 17 %. The decline in retail by 29 % is considerably higher.

The ‘Abbey and Trappist’ beers type has a status quo in the on-trade, while it declines 5 % at retail. This type represents 10.5% of the total beer market.

‘Specialty’ beers consisting of heavy blonde-, regional-, pale-ale-, stout-, scotch- and Xmas beers is the only category making gains in both channels. 10% increase over 2019. 1% in on-trade and 20% increase in retail. This category accounts for 14.4% of the Belgian beer market in 2022. In 2019, it was 12.7%.

The “fruit” beers (gueuze, kriek and fruit beers) experience a similar decline in both channels. 10 % in the on-trade and 8 % in retail.

The share of specialty beers in the on-trade increased by 1 % in 2022 vs. 2019 (40.5 % vs. 39.5 %)

430 breweries produce all these beers. 30 % of their production is sold on the Belgian market. 70 % or 16,390,562 hl. is destined for export. Of these, 82 % are sold within the EU. The main markets within the EU are France, the Netherlands and Spain. The main countries outside the EU are the United Kingdom, China, the Russian Federation (before the war in Ukraine), USA, United Arab Emirates and Australia.

Compared to 2012, exports have increased strongly both within the EU (+51.52%) and outside the EU (+16, 73%). Over the last three years, however, export volumes have been declining because a number of breweries have chosen to start local production of their beers as part of the sustainability goals they have set.

Looking over a longer period, we have to note that over the last 10 years the Belgian beer market has shrunk by 16%. Over a period of 20 years, it is even 30%.

Source: Belgian Brewers – Annual Report 2022