Switzerland: Beverage Wholesale Market 2021

Swiss Market Analysis 2021 – The year in figures

Published by DIGITALDRINK, in SwissDrink Inside 2022.01

The year 2021 is already history again. Another year marked by the pandemic and the associated restrictions and changes in daily life. Closed catering establishments, a wet summer and new Covid variants have depressed the result. However, we can point to bright spots and positive developments that make us confident for 2022.

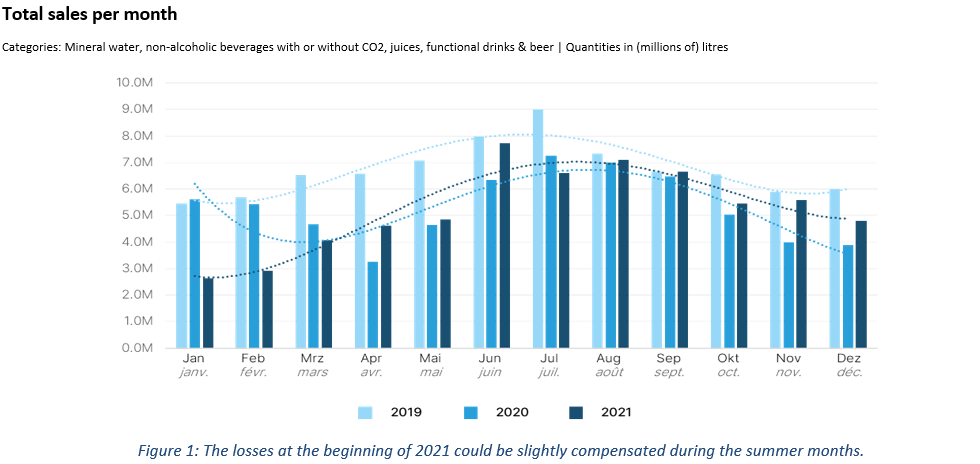

The year got off to a difficult start. The closure of restaurants, bars, leisure and sports facilities imposed by the federal government in December 2020 left a clear mark on beverage sales until it was lifted in April. The home office obligation introduced in January led to an additional shift in consumption from the on-trade to the off-trade channel. After the first quarter, the sales index was thus only around 63% compared to 2020, or only 55% compared to 2019 (see Figure 1).

The reopening in April led to a slight recovery to an index of 89% against 2020 and 68% against 2019 by the end of the second quarter. This was followed by the introduction of the Covid certificate in June which, combined with an improvement in the weather, resulted in sales volumes during the summer that were comparable to those still achieved in 2019.

The development only slowed down again with the colder temperatures, the emergence of new Corona variants, the resulting increase in the number of cases and the resulting cancellation of Christmas dinners in many places. At the end of December, the volume of drinks sold was at an almost identical level to 2020, at 99% and thus at a comparable 78% compared to 2019.

The restaurant industry continues to suffer, despite a slight lull in the At Work circuit

The losses in the first quarter of 2021 in the restaurant sector could not be fully compensated for in the remaining months, although monthly sales were mostly above the previous year’s levels. Ironically, July, usually the strongest month in terms of sales, was one of the five wettest months in northern Switzerland since measurements began, according to MeteoSwiss, which is why sales literally fell through the floor.

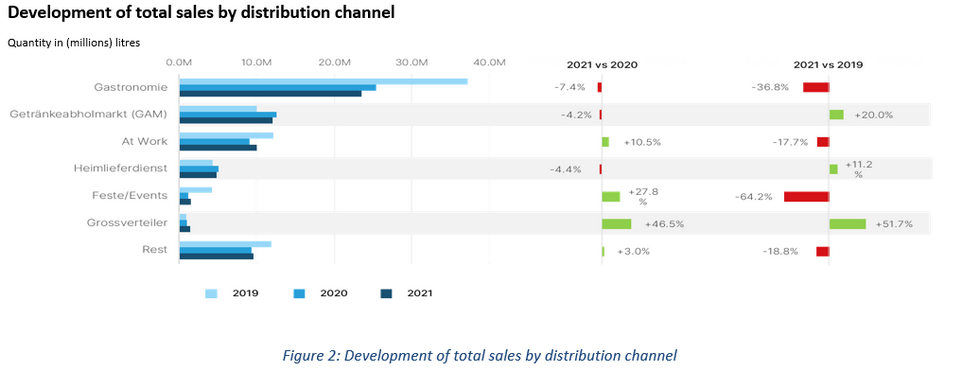

Compared to 2019, there was a slight improvement in the At Work marketing channel, which was heavily penalised due to repeated home-office obligations. Compared to last year, an increase of 10% could be achieved (see figure 2), while some months even showed higher values than in 2019.

Sales of self-service drinks shops and home deliveries stagnated slightly. While they were able to increase by a remarkable 20% and 11% compared to 2019, they still reach an index of 96% compared to the previous year. It is to be hoped that this level can be maintained in the long term.

Still water, energy drinks and wellness water are on the rise

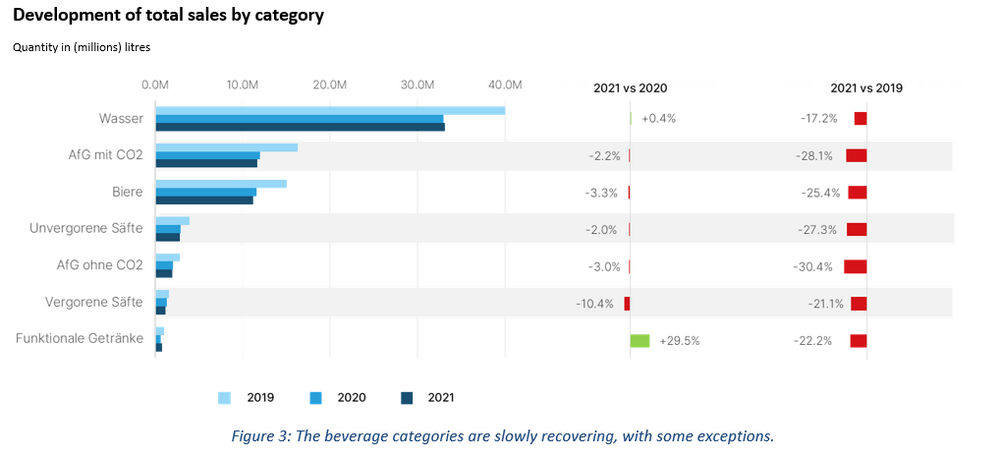

The development of sales by category shows that they are under as much pressure as in the previous year and in 2019 (see Figure 3). As the strongest sales category, mineral water suffered the least and was even able to increase slightly compared to 2020. The positive development here is exclusively due to still water, while the carbonated and flavoured variants showed a slight decline.

In carbonated soft drinks, colas and orange drinks were able to maintain their sales overall, with a slight trend in favour of national and regional brands. On the other hand, sweetened carbonated drinks with lemon, grapefruit and lactose suffered losses of 5-7%. Volumes of tonic and bitter drinks grew continuously, albeit at a modest level, but still positively.

Functional drinks also show a positive trend. Both energy drinks and sports drinks managed to grow by another 10% compared to the previous year but, as before, they still only account for 50% and 84% of the 2019 volume. Wellness drinks with well-known representatives such as FOCUSWATER and Vitamin Well were again able to increase sales dramatically.